4/27/2020

- andystruck

- Apr 27, 2020

- 12 min read

Hello there,

Hope all is well. The Last Dance is absolutely fantastic. Maybe it is because the world is starved for sports so anything sports related that we see is just magnified and put on a pedestal more than it would have been if life was normal. It is amazing to see just how much ego management takes place behind the scenes in professional sports. Phil Jackson knew "x's and o's," but there is a good chance that many other coaches knew them better. What they didn't know better and what makes Jackson one of the all-time great coaches is his ability to manage egos. He had to handle an always ultra-competitive MJ, a Rodman who showed early signs of being America's ambassador to North Korea, and a financially angry Scottie Pippen while juggling Jerry Krause and how much his team hated him. Then after that he went on to manage an emerging Kobe and an established Shaq. We won't ever bring up the Knicks thing though. Everybody gets a pass at some point and that is Jackson's. The Last Dance at least gives us sports while the NBA and MLB are letting out whispers of firing back up. The NBA appears to be within a couple of weeks of at least opening practice facilities back up. The MLB is possibly building a bio-dome in Arizona or Florida that will not let anyone in our out so they can start their season. It seems like a bad re-make of The Truman Show but with all of MLB's personnel. The NFL draft happened and that was kind of fun as it was all done virtually. Sports are here and there and hopefully they will soon be here full time in some capacity again. In the meantime, you always have the #bucketsblog.

April 27, 2020

U.S. oil prices jump out of a plane, forgets to put on its parachute first

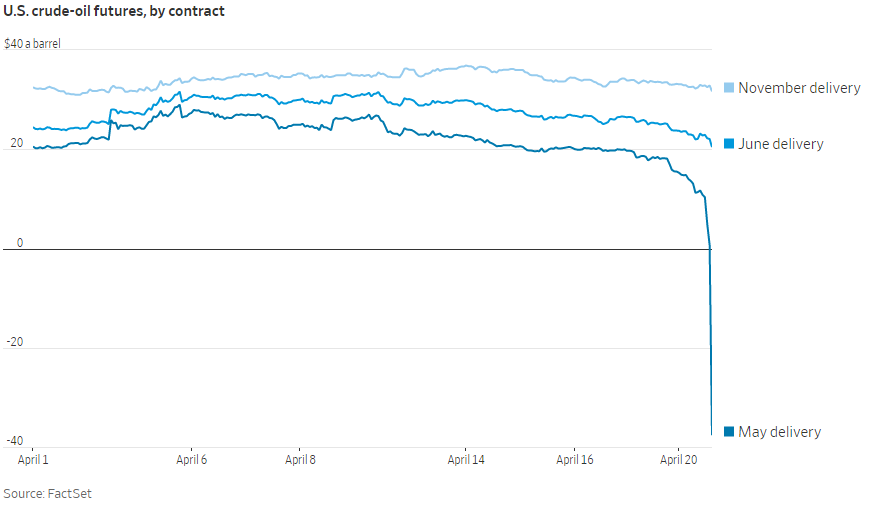

Nothing beats the adrenaline rush of sky-diving quite like forgetting to put on your parachute first, right? U.S. crude prices aka WTI aka Master of Getting Beatdown had a historic day for all of the wrong reasons last Monday - April 20th. The U.S. Women's National Team destroyed Thailand in the 2019 World Cup by a score of 13-0 and even Thailand's team looked at WTI on Monday and felt bad for it. OU's football team looked at the destruction and finally started feeling better about themselves for the first time since LSU made them look like my one-win seventh grade football team in the College Football Playoff last year (RIP - sports). Anyone who was ever dunked on by an in-his-prime Shaq passed on their condolences to WTI. Michael Jordan himself, for the first time in his life, felt bad for an opponent. Nah, that didn't happen. MJ probably challenged WTI to a game of one-on-one and WTI decided to try and hide under the earth to escape his wrath. What happened you say? The May WTI price finished the trading day at -$37.63. Yes, you read that correctly. There is in fact a negative sign in front of that number. WTI decided to go full Star Trek and go where no commodity price has gone before. Sellers of crude will be paying buyers of crude to take the barrels off of their hands in this instance. May WTI prices finished Friday's (17th) trading day, which was the one prior to Monday, at $18.27. Doing some quick math and that is a $55.90 fall in one day which is a +300% one day drop. Of course both are good for all-time records. So how does that look in a chart? It looks like someone was drawing a line and then fell asleep right at the end:

Basically what this means is that a major market player on the financial side was caught holding physical crude contracts the day before the May contract closed for trading (21st) and absolutely had to get rid of them. When a market player holds a WTI contract, then the player is required to physically take in as much crude as he has bought according to his contracts unless he unloads them before that future month expires. Surely more news will come out about this in the future on what entity or entities were holding these contracts and had to unload them because they had no physical storage space to take on these barrels. What this also conveyed is that the U.S. is basically out of crude oil storage. Who would have thought that America would ever be in a place where literally every bit of infrastructure across the country would be filled to the brim? Although there are a few nails in the coffin, the lid isn't fully sealed on the fate of U.S. oil and gas companies yet. The June WTI contract lost 18%, which is still a ton in value, on that same trading day (20th) but closed at $20.43. November's contract closed at $31.66. For now, there are enough market players willing to pay some sort of money for a June barrel of crude oil. We'll see how that holds up over the next month. May WTI prices were around $20ish most of this last month until the day before the expiration day of the contract. June could very well do the same if production cuts across the globe do not end up being enough. Hopefully June prices don't experience the same fate as May's because I used up all of my sports analogies for this already. However, a big time energy analyst, Paul Sankey of Mizuho Securities, delivered a dire message about the June contract on Tuesday (21st). Mr. Sankey warned that the June contract could fall to negative $100/bbl. His words:

Will we hit -$100/bbl next month? Quite possibly. We have clearly gone to full scale day-to-day market management crisis, and as we said when we first called for negative prices, the physical reality of oil is that it is difficult to handle, volatile, potentially polluting, and actually useless without a refinery.

He does not want his call to become right as he said himself that he "would rather not have (this one) come true." Hopefully it does not. Yikes.

U.S. E&Ps might soon find an extra dollar in their pocket

One of the best feelings in the world is reaching into your pocket and finding some cash in there. Even if it's just $1 it feels like you've just won the lottery. US E&Ps could use a few dollars themselves. Everyone else in America is getting bailed out with direct loans from the Fed except the oil and gas industry. Help may soon be on the way though. Pretty much at the direct request of President Trump, Treasury Secretary Steven Mnuchin and his department plus the Dan Brouillette's Energy Department are looking for ways to financially support U.S. independent oil and gas companies. The Energy Dept has a plan drawn up on a white board somewhere that will allow oil and gas co's to utilize their reserves as collateral in order to secure federal loans or there is an option to exchange equity ownership in the company for these loans. The white board this plan is drawn up on is rumored to be the same one that Scott Brooks used when he had the three headed monster of snake, Harden, and RUSS and he just wrote down "someone shoot a 35 footer" on the board at the end of games and then just hoped for the best. This worked out surprisingly well for ole Scotty most of the time. Billy Donovan actually tried to draw up plays but then RUSS always just jacked his marker in the huddle and just wrote "RUSS" on the whiteboard over whatever play that Billy drew up. Surprisingly that worked out pretty well most of the time too. Back to boring money stuff. Energy co's are in a tough spot as they were basically left out of the massive $2.2T relief package that was passed in March as Dems kicked out a proposal that would enable the fed to buy up crude to place in the Strategic Petroleum Reserve (SPR). Since then, the Trump administration has been scrambling to find ways to keep oil prices from cratering further and causing irreversible damage to America's oil producers and these efforts were accelerated on Monday (20th) when oil prices went negative for the first time ever. However, all efforts still seem like a long-shot as Dems are not on-board with bailing out oil and gas companies due to climate reasons. This might not be the right time to pick that fight since oil and gas co's still employ hundreds of thousands of billions of trillions of people and, you know, produces a vital commodity right here in the States that enables the entire economy to go. Other efforts are ongoing at the state level as the regulating bodies of Texas, Oklahoma, and North Dakota are all looking at forcing production curtailments in their states to prevent "economic waste." Texas passed on making this happen on Tuesday (21st) but will revisit on May 5th. Oklahoma's energy commissioners voted in favor of allowing oil producers to close wells without losing their leases in order to prevent "economic waste" by draining state resources at a loss. This will move on to Oklahoma's Corporation Commission on May 11th along with a request to outright limit Oklahoma's oil output. North Dakota are still reviewing this type of action.

The great re-opening is kinda sorta starting and may not be that great

States across America and a few European countries are starting to move forward with plans to "open" their economies back up. It's going to be more like a Thabo Sefolosha in OKC open though. Everyone sees that he is open but no one really wants to get him involved in the offense because of BRICKS. He was really good defensively but terrible offensively. OKC thought they would never see a two guard like that again and then Andre Roberson walked through the door and was somehow better than Thabo on defense but somehow worse than Thabo on offense. It was like Sam Presti cloned Thabo but didn't quite have all of the bugs worked out of his cloning technology. As of April 21st, South Carolina, Georgia, Oklahoma, Tennessee, Alabama, Germany, and Italy all announced plans to loosen their various forms of "stay at home" orders and allow a slew of businesses to open back up by at least May 1st. New York and California have went the other way and announced the lockdowns in their states would continue past May 1st. A couple trends to notice here is that all states mentioned in the WSJ article that are re-opening are southern states that have Republican governors, including Germany and Italy. Nah. Just kidding. Germany and Italy have Dem governors. What would it take for America to trade for these two countries? The U.S. tried to trade for Greenland last year and was shot down. What would it take? Would the U.S. be willing to offer three islands in Hawaii, San Francisco (see ya Warriors!), Wyoming, western Florida, and the rights to the next two states to be brought into the Union to the Eurozone in exchange for Germany and Italy? That is quite the haul for the rest of Europe and Germany doesn't exactly have a rich history of being a solid team player. Italy is well past its Roman prime and this might be a good time to flip it for a younger island chain in Hawaii. There needs to be a trade machine for this type of thing. There has been a bit of backlash from other political leaders within each state where the governor wants to open back up. Georgia is the poster child so far. Atlanta has a Democratic mayor, Keisha Lance Bottoms, that came out and said she was "at a loss" over the decision that Governor Brian Kemp made this week. She stated to CNN that she doesn't see any supporting data that the decision is being made on and implied it is being made in haste. That is really the same argument that Dems have made across the board. There seems to be a growing divide between the two leading political parties. Republicans are getting nervous about the economic destruction that is occurring and do not want to see it continue. Dems are worried about opening up too soon and causing an even deadlier second wave. It would be interesting to see if arguments on both sides would change if this were not a presidential election year.

VP Mike Pence thinks the U.S. will mostly have roundhoused COVID-19 by June

The assistant to the regional manager hopes America will have COVID-19 "largely in the past" by early June of this year. Mr. Pence heads up the White House task force that is responsible for all things COVID-19 at the federal government level. Part of his responsibilities include setting guidelines for how / when states should open and then highly suggesting that each state meet these guidelines before they begin re-opening. As mentioned above, some governors, like Georgia's, are going full Melo on the block and doing his own thing anyways. Mr. Pence told the WSJ that "trend lines continue to be encouraging," even in some of the hardest hit cities. Then he goes on to say:

We truly do believe as we move forward, with responsibly beginning to reopen the economy in state after state around the country, that by early June, we could be at a place where this coronavirus epidemic is largely in the past.

Hopefully he ends up being right but that seems like a really aggressive timeline at the moment. It is probably safe to say that most people have a bit of cabin fever and would love to be released back into the wild, but that doesn't seem like a reality until ubiquitous testing, required mask wearing, mandated #bucket getting, or something like that is in place with the mass re-opening of states and cities. Just because things are deemed to be "open" again doesn't necessarily mean that everyone is going to run about like a dion looking for the ball so he can go DION. There are a few warnings of a second outbreak occurring in the fall however. Dr. Robert Redfield, head of the Centers for Disease Control and Prevention, warned the second wave could be "more difficult" than the initial wave that is occurring right now. Mostly the concern is around the stress it would place on hospitals and health workers as the seasonal flu would be up and running and then COVID-19 cases will likely be picking back up to some degree. He clarified that he did not say the second outbreak would be worse than the first, just that it will strain the healthcare industry substantially with the one-two punch of sicknesses coming at them. Mr. Pence then went on to say that "an enormous volume of testing" will have been conducted by the fall to identify victims and that many Americans will have developed "a significant amount of immunity" once the virus has came and went through their immune systems. Then Mr. Pence finished up with a verbal elbow drop on China and the World Health Organization by saying both lacked transparency, candor, and did not provide proper advanced notice to the rest of the world about the oncoming pandemic.

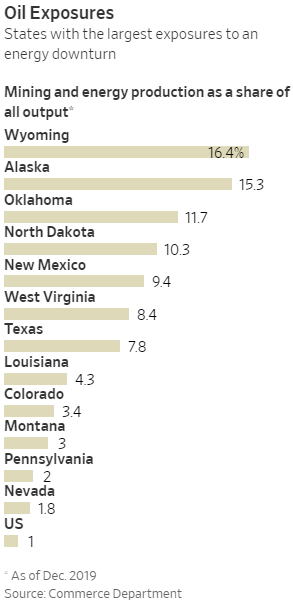

Cratering oil prices are costing states some big-time dollars

Oil busts effect far more than just the companies that extract the commodity. A few states across America depend heavily on income related to the extraction of oil and natural gas. If prices are down, then less drilling occurs, which means less revenue for states to collect which leads to devastating budget shortfalls. Wyoming, Alaska, Oklahoma, North Dakota, West Virginia, Louisiana, Texas, Ohio, and Pennsylvania all have significant oil and gas activity occurring within their borders. The last three have a pretty diversified state economy however so any drop off in drilling activity doesn't effect them nearly as much as the others on that list. Louisiana, Ohio, and Penn are mostly tied to natural gas fluctuations as well so the drop off in oil prices may actually benefit these states if natural gas prices respond inversely.

As the graph to the left indicates (via WSJ), Wyoming has the largest exposure to oil in terms of how much it contributes to the state's output and budget. The rig count in Wyoming has dropped from 30 last year to just 6 now and could reach zero by June, according to Pete Obermueller - president of the Petroleum Association of Wyoming. Oil revenue has provided Wyoming with a way to shift away from relying on coal production to support its state output and budget, but now oil is in jeopardy of not being able to fulfill its money generating capabilities. Mr. Obermueller estimates that at least 1,700 jobs have already been lost that were tired to the oil industry. The industry had contributed $1.4B to Wyoming's budget in 2018 which amounts to roughly half of the state's annual general fund. Wyoming is in bad shape. Not too far behind it is Oklahoma. The rig count there has dropped by half as it now just has 24 rigs compared to 48 at the beginning of this year. Like Wyoming, Oklahoma is staring at a looming budget shortfall as the state is currently projecting a deficit of ~$416mm for 2020. Luckily, and due to planning really well, Oklahoma has ~$1B in various forms of savings accounts in order to help weather the COVID-19 storm. On top of that, Oklahoma is expected to receive ~$844mm that is a part of the $2T federal aid package. Score one for solid planning on the savings front for Oklahoma.

Thoughts of the week:

The first round of the NFL draft happened last Thursday (23rd). There were quite a few basketball highlights of players who were drafted. Most of the hoops highlights were actually pretty impressive which convinced me that the Knicks are going to somehow trade away their actual NBA draft first round pick for an NFL third round pick and take some running back that has a killer dunk video from high school.

Dennis Rodman getting permission from Phil Jackson and Michael Jordan to take a "48-hour vacation" in the middle of the season is one of the most underrated wins in NBA history.

Comments