3/23/2020

- andystruck

- Mar 23, 2020

- 15 min read

Updated: Mar 24, 2020

Hello there,

I hope everyone survived what was the first week of mass quarantining that is going on across the nation. Also would like to say congratulations for making it through week one and keeping your sanity. Hopefully this week's #bucketsblog won't be the final straw that breaks you. News has been abundant lately and there is so much to read and digest. This has turned out to be a great time to have a firm grasp on how statistics are developed, presented, and what they actually mean. Some good news, I did not have to take my stats class in my undergrad. That was cool at the time. Some bad news, I wish I did now. Lesson learned: none. If you can get out of a class then go for it and regret it later. Kidding. Kind of. There is still no sports. I still haven't quite adjusted to that reality and I'm not sure that I want to. I might go find every Chicago Bulls game from the '91-92 season or somewhere around that time-frame and watch every game as if it were live so I can see prime Jordan again. One would think that Netflix, Amazon Prime, and Hulu would be killing it right now right? What else are people going to watch? The news?!? Yaa right that is too stressful. Might as well get your stress in by reading this blog. The federal government is working on bailouts, oil prices are following the dion/DION game-to-game box score plan, and airlines make a lot of dollars but then poof, it's gone.

March 23, 2020

Federal government might bail out.. consumers..?

We are old enough to remember the massive federal government bailout of major U.S. banks and auto-manufacturers in 2008 - 2009. In total, President Obama and President George W. Bush committed $426.35B to the big bank and auto bailout and ended up earning $441.7B from the sale of stock and interest payments once the entire process was complete, according to the New York Times (NYT). Overall, it seemed like the bailout was a success as it helped stabilize a crashing economy. However, movements started on the left (occupy wall street) and the right (tea party) because of this action and divided the nation a bit more politically than what it already was. There is always a cost in making a decision that carries as much weight as that. Nowadays the pandemic is wreaking having on everything in its path and leaving no major economy unscathed. Big banks didn't cause this to happen because of shady mortgage policies. Major auto-manufactures are not at fault. The airline industry is struggling mightily but it had nothing to do with the coronavirus outbreak. This just happened and now pretty much every developed economy across the globe is suffering. Lawmakers in Washington have been working on a bailout for everyday citizens this past week and are hoping to have some type of deal for citizens complete before the end of March with the goal of getting something done as soon as possible. According to the Wall Street Journal (WSJ), the Trump administration is targeting an economic stimulus package worth roughly $1T (yup, that T is for trillion) while Senate Democrats are floating around $750B. The $250B divide really isn't a divide, but it is moreso how that last $250B will be allocated. Democrats are looking to expand unemployment insurance and place a moratorium on foreclosures and evictions. The Trump Administration would like to suspend the payroll tax and offer relief to certain industries. The citizen stimulus looks like it could be worth $500B in direct cash payments that are distributed across two $250B tranches. Another $50B would be allocated towards the airline industry and $500B would be directed towards small businesses in order to keep them afloat while the majority of American citizens are basically participating in a voluntary quarantine that really doesn't have a firm end date. As of the 17th, the amount per adult would exceed $1,000 and then possibly $500 for each child. There will be mechanisms in place that will prevent millionaires and billionaires from receiving this part of the stimulus and discussions on which income brackets to actually include were still in discussions. For the most part, it looks like lawmakers are coming together on this really well and actually, you know, functioning like a team, putting politics aside, and getting things done. That is really nice to see for a change. It would be nice if it didn't take an event of catastrophic proportions for this to occur though. Below is a nice high level summary of what is happening in terms of economic stimulus right now, courtesy of WSJ:

CORONAVIRUS PACKAGES

Congress is working on various pieces of legislation related to coronavirus. Here is a rundown of what has been completed, and what lies ahead.

Phase 1: Completed

Congress passed and President Trump signed into law an $8.3 billion bill that funds vaccine development and provides money to state and local governments to assist with prevention efforts.

Phase 2: Near Completion

The House passed last week and the Senate is expected to soon take up a bill that expands unemployment insurance, offers paid sick leave to workers, and mandates that testing for the virus be free. Mr. Trump has endorsed and is expected to sign the package. A nonpartisan committee estimates that the tax credit provisions of the bill cost nearly $105 billion.

Phase 3 and beyond: Proposals

The Trump administration is eyeing a stimulus package worth roughly $1 trillion and Senate Democrats are floating a $750 billion proposal. While Democrats favor an additional expansion of unemployment insurance and placing a moratorium on foreclosures and evictions, the Trump administration is eying suspending the payroll tax and offering relief to certain industries. Other ideas in the mix on both sides of the aisle are providing capital relief to small businesses and giving Americans direct cash assistance. Lawmakers have said the next steps could come in a series of future legislative packages.

...And then partisan politics happened and it didn't pass when it was supposed to

The total bailout package is worth at least $1.6T at the moment. This was voted down on Sunday (22nd) but Senate Democrats and then again on Monday (23rd) by Senate Democrats. What is tying this up? According to WSJ, it is because:

Democrats and Republicans disagree over conditions on hundreds of billions in funding for America’s largest companies and the level of aid for hospitals, states, and unemployed workers, among other matters.

I mean, what do you do with that? America needs something to happen in Congress in order to help out those who are getting laid off, about to get laid off, or are unable to earn money because they are hourly workers who literally are not allowed to go into work. That is also enough money to attach a rocket to the moon and send it into the sun just for fun, probably. A ton of money is at stake so on one hand, is now the time to be prudent and get it as correct as possible in regards to distribution? Or is now the time to bring up the old saying about how "perfection is the enemy of progress" and move forward with how the bill is structured? Who knows what the right answer is. Politically this doesn't look great for Democrats though so there has to be something seriously flawed in this package for them to risk this much political equity in order to hold this up. The story below is from the WSJ article this blurb is based on. It is telling about how dysfunctional Washington seems to be right now during a time it absolutely cannot afford to be:

Mr. Schumer then objected to allowing Sen. Susan Collins (R., Maine) to speak. Ms. Collins, whose re-election campaign is facing an onslaught of negative advertising by a group backed by Mr. Schumer, left her seat and crossed the aisle, raising her finger and pointing at him, saying “You are objecting to my speaking? This is appalling!”

Very frustrating to read something like that in a time like this. There is always more to the story, of course, but this is about as bad of a story that could break from the Senate floor in regards to thinking both parties are coming together when America needs them to. In this bill, individual Americans would receive a one-time payment of $1,200/adult and $500/child with payments being cut off at a certain income level. Unemployment benefits would also expand as the bill would provide up to 39 weeks of assistance which is up from 26 weeks that most states offer. The top controversial item is the $500B that will go towards distressed businesses that are mostly in the airline and cruise industries. Democrats are concerned this will become a political tool to reward companies that President Trump favors. Long story short, it seems like the Democrats are mostly targeting tighter restrictions on how that money can be distributed and they also are seeking to encourage companies to retain employees through the downturn. Treasury Secretary Steven Mnuchin fired back by saying this wasn't a "slush fund." Instead, he stated that:

It’s a mechanism that we can use working with the Federal Reserve that will provide another $4 trillion of potential liquidity into the market.

I made a mechanism recently but it was to convert an old cardboard diaper box into a temporary keyboard tray in order to try and survive working from home without contracting carpal tunnel at a young age. Currently that is failing. Anyways, getting back to the math on the $4T. Mr. Mnuchin and Mr. Trump believe that for every $1 that is injected into the economy via Congress, then this will result in the Federal Reserve being able to provide $10 in liquidity to distressed companies. So $425B is the stimulus for this specific measure that would result in $4T overall being available to large corps in distress. Chief investment officer at money manager Guggenheim Partners LLC, Scott Minerd, does not see how $4T can be derived out of $425B since the initial $1 is going into troubled assets. Just because I wrote it, doesn't mean I understand it. Haha. There it is though. The biggest crux of the impasse in Washington is how funding will be provided to distressed companies. House Speakers Nancy Pelosi said on Sunday (22nd) that House Dems planned to introduce their own legislation soon. Great. So two packages will be up for negotiation and voting. Although the House Dems thing seems like a leverage play right now and maybe even a nuclear option. Both sides know that if it gets to that point, then it is probably too late for the fed government to try to intervene and stave off an economic wreck. Maybe Washington could use some encouraging cat posters with inspiring sayings on them like "teamwork makes the dream work" or maybe they should all sit down and watch Remember the Titans or Miracle or something so they can be inspired to work together and overcome obstacles. You know, things ordinary people are told to do everyday.

Oil prices are about to hit kyle singler levels

Ah the legendary kyle singler. The man who had a great college career, a couple solid seasons with the Pistons, then was traded to OKC, signed a 5-year deal, and then promptly forgot how to basketball right after he signed the deal. He was then bought out before the fourth year of his deal and will be getting paid by Clay Bennett through the year 2023 now at just under $1mm/year. Legendary stuff from the former Duke boy. Well done on his part but not so well done on Presti's and the Thunder's part. Yikes. A good player does not get bought out like that. Instead, a horrendous one gets bought out like that because of abysmal performances. In his last year in the NBA, Singler shot a paltry 33% from the field. Sadly, oil prices fell below $33/bbl on the 17th. Oil prices have officially passed the Singler line, which is now the NBA equivalent of the MLB's Mendoza Line. Some smart dudes named Fatih Birol, International Energy Agency's (IEA) Executive Director, and Mohammed Barkindo, OPEC Secretary General, recently expressed "deep concerns" about the current prices of oil and what type of wide-ranging, global impacts that could have if nothing is done to prop up the price. The coronavirus pandemic could have "potentially far-reaching economic and social consequences," according to Birol and Barkindo. Both dudes believe that developing countries could see their oil and gas income fall by 50-85% in 2020. This drastic fall in income will likely lead to oil and gas revenue dependent countries to come up short on funding things like health care and education. No relief appears to be in sight unfortunately. Saudi Arabian leadership doubled down recently as the camp said it was "very comfortable" with a $30/bbl oil price. Russia was not to be outdone and restated its belief that it can withstand lower oil prices for up to a decade. Leaders from fellow OPEC members like Iraq, Algeria, and Nigeria have all been desperately trying to get Russian and Saudi leadership back to the negotiating table as these countries are particularly vulnerable to any type of medium-to-long-term price war. Iraq has one of the least diversified economies in OPEC and would likely require some type of assistance from the rest of the world to survive. American shale producers are in rough shape as well but can likely be bailed out by the U.S. government if things get bad enough. Part of what the fed could do to prop prices up temporarily is to buy crude that would go straight into America's Strategic Petroleum Reserve (SPR). The SPR was created in the 1970s in an attempt to ensure America can survive supply shocks of any kind. Congress has been selling off SPR oil in recent years in order to raise money for budget purposes and it viewed America as having an abundance of oil due to the shale revolution. Selling off some of the SPR made sense at the time. Now, there is a little bit of room in the SPR tanks so the Trump administration directed the Energy Department to begin buying American produced crude in order to fill up the SPR and try to stabilize WTI prices a bit. WTI is the American based global oil price whereas Brent is typically viewed as the actual global benchmark. This might work out well for the U.S. government and U.S. oil producers. The government will be buying crude at a ridiculously low price while crude producers will hopefully see a bit of WTI price stabilization in return. According to S&P Global, there is ~92mm bbls of capacity available throughout the entire SPR system. WTI oil prices initially popped 5% when the news first broke on the 13th. However, it took less than a week for those gains to disappear as WTI prices are now south of $30/bbl.

And then Oil Prices hit the Mendoza Line...

WTI prices were apparently offended by being grouped with the infamous singler so it decided that it would rather decline further and live life being grouped with Mendoza instead. WTI prices did just that last Wednesday (18th) as prices crated to their lowest point since February 2002 as it hit $20.37/bbl during trading. That was good for a 24% drop in a single day. The reason behind the steep decline was the combo of the Saudi and Russian price war and according to a commodity trader at Global Risk Management, Edward Marshall:

Larger governments taking the coronavirus risk more seriously and imposing stronger lockdown measures. Forward guidance for demand is being decimated.

Thanks Ed, leader of the bad news bears, for the uplifting view. Ah, what is that you say? You prefer to have an uplifting view provided in a chart? Gotchya:

Psych! Thanks Andy, co-leader of the bad news bears. How long has it been since someone used the "psych" joke? Things are getting weird here. Working from home is kinda sorta cool but the downside is that my home office is setup on my wife's vanity so now I get to look myself in the eye whenever I make a mistake at work. Insanity seems nearer than it ever has before. Saudi Arabia set its production target at 12.3mmbpd for the next few months. Combine too much production while oil demand is cratering because of coronavirus hammering everything in its path and, well, here is what happens. Goldman Sachs has slashed it's Brent price to $20/bbl for 2Q-20 as a result. Brent typically trades ~$3-$5/bbl higher than WTI so when that is factored in and if it holds steady, WTI crude could end up averaging ~$15-$18/bbl for 2Q-20. Awesome, so there is even more room to go down on WTI price. Things can change suddenly though. It doesn't seem likely, prudent, or economic that Saudi will continue its price war for Russia for very long. That is a wild guess though. Nothing can be known or thought to be known in markets right now. Panic seems to be winning out over pragmatism in terms of markets and economies, but who can really blame anyone for that happening. This seems like truly uncharted territory for the entire world. Oil is not the only commodity selling off though. Copper - a building block in construction, the electric grid, and autos - dropped by 6.7% last Wednesday as well which is good for the lowest level for it since 2016, according to WSJ. Oil has company in the basement now so it's not as lonely as it usually is down there.

Ah, but wait, oil prices sky-rocket on Thursday (19th)

WTI oil prices refuse to be classified with anyone else on the planet. After dropping by 24% on Wednesday (18th), oil prices jumped 24% the next day which represents a record in terms of a one day percentage gain, according to WSJ. WTI price rose to $25.22/bbl by the end of Thursday. In that context, prices are still in the Mendoza - singler range but it has been trending on a dion/DION game-to-game box score all week. How can anyone not love how WTI prices are tracking with dion/DION? Why-oh-why did the massive percentage gain happen? The U.S. Energy Department, aka Dept of RUSS, formally requested to buy up to 30mmbbls of crude to fill up the SPR in an attempt to ease the massive selloff of the commodity. Plus, the U.S. is now looking to intervene in the Russia vs Saudi price war. From WSJ:

The U.S. was considering a diplomatic push to get the Saudis to cut oil production back to levels they had originally signaled. The Trump administration is also weighing possible sanctions against Russia.

Despite the positive news, overall sentiment for oil is still bearish, according to the director of the futures division at Mizuho Securities USA Robert Yawger. Mr. Yawger's take on the one day price spike:

Although there is some hope among traders that a U.S. intervention might help the Saudis and Russians reach a compromise, part of the day’s rise is also being driven by short sellers covering their bets.

Mr. Yawger could win the lottery and probably find a way to complain about how he has to be paid in $100 bills instead of $20s or something. Sadly though, he probably isn't wrong. Demand is still getting wrecked because of coronavirus and production is still strong everywhere. U.S. producers have began lobbying the Trump Administration to directly intervene, diplomatically, in the Russia vs Saudi standoff. This group is being led by OKC-man Harold Hamm. He is asking the Trump Administration to conduct:

Anti-dumping and/or countervailing-duty investigations of Saudi Arabia, Russia and potentially others for selling so much crude at “prices below market value.”

In addition, oil executives are pleading with the state of Texas to curtail production in the state by as much as 500mbpd for the remainder of the year. Each producer would cut production by 10% with exceptions being made for smaller producers. This has been done before but not since the 1970s. This effort is being led by Pioneer Natural Resources CEO Scott Sheffield. As of now, it is unclear if Texas regulators will take on such measures. In regards to the Trump Administration stepping in between Russia and Saudi Arabia, Mr. Trump is hesitant to do so. Mr. Trump's words:

We have a lot of power over the situation. We’re trying to find some kind of medium ground. It’s very devastating to Russia because when you look, their whole economy is based on that.

Mr. Trump also stated that he was "a little torn" on how to address the two countries. Hesitation seems to be creeping into his decision making with Russia specifically. Trump indicated that Russia would suffer the most if future prices stay this low. Likely true when only comparing Russia vs Saudi Arabia. On the down side of possibly sanctioning Russia's oil exports, there is a real concern that goes back a few administrations that restricting oil exports could escalate diplomatic tensions between the two countries. Ain't nobody want to even get close to sparking another Cold War type thing.

U.S. Airlines have been rolling in cash the past few years, but where did it go?

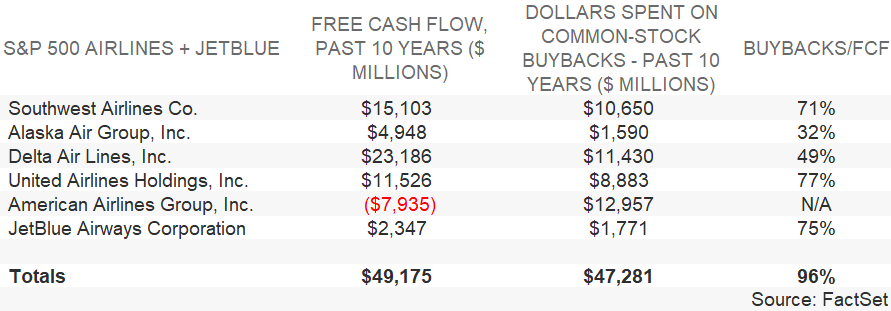

America's biggest airline companies have been raking in free cash flow for the most part over the last decade. The chart below, via MarketWatch, shows how much free cash was being delivered at America's biggest airlines and how much of it was spent on share buybacks:

Major airlines had ~$50B in free cash over the last 10 years and spent a whopping 96% combined on buying back shares. Now these same airlines are asking for a federal government bailout for ~$50B. Why do companies engage in share buybacks in the first place? Below is a high-level summary for the reasoning behind it, courtesy again of MarketWatch:

If the share count is reduced, it boosts earnings per share.

If a company is issuing a significant number of new shares as part of its executive-compensation packages, buybacks mitigate the dilution of other shareholders’ ownership percentages.

Executives cannot think of any better use for the money (such as expansion, equipment replacement, new product or service development, etc.), or maybe because the executives and board members are overly fixated on quarterly earnings results and boosting the share price, rather than the long-term health of the business and its ability to navigate storms.

Analysts, investors and corporate executives often call buybacks a “return of capital” to shareholders. This isn’t necessarily the case if the share price declines, despite the buybacks, or it eventually becomes clear the company was underinvesting in its ability to deliver competitive products and services.

Instead of saving a decent amount of free cash flow for rainy days, major airlines engaged in a strategy where it is difficult to realize if it actually made an impact on their overall stock price. The only bump that could be tracked relatively well is the bump in earnings per share that is reported every quarter as there would be less shares to put earnings against, thus making it look better when in reality earnings could have been the exact same or worse overall. This is going to make for an interesting time for top decision makers in Washington on whether or not to bailout the airline industry after it is showing an inability to even survive one quarter of lost demand despite proving it has the ability to spin off a substantial amount of free cash. In the broader picture, there could be discussions of an outright ban on buying back shares. At minimum, it seems like increased regulation is going to come out of this that will limit a company's ability to buyback shares. It would be pretty sweet if companies were required to provide a bonus to its employees that would match, dollar for dollar, the amount that corporations were planning on using to buyback shares. Below is another sweet chart sourced from Bloomberg about the cash carnage:

Thought of the week:

Why can't there be a healthy pandemic that breaks out? Wouldn't it be way better if social distancing was discouraged so people could contract the healthy virus that all of a sudden makes everyone feel fantastic? Let's have that be the pandemic next time.

Comments