3/2/2020

- andystruck

- Mar 2, 2020

- 15 min read

Hello there,

I hope everyone had a good weekend. The Thunder had a wild start to the week in which they tried to blow a 20+ point lead and lose to the Bulls and then decided to come back from almost 20 down to the Kings. Both ended up in victories somehow and the Thunder team was starting to look invincible. However, a schedule loss was on deck on Friday night against the might Milwaukee Bucks as the Thunder were playing their third game in four nights and on the second night of a back-to-back. Competing and losing in this game would have been expected, OKC competed for about five minutes and then were annihilated thoroughly and lost by a cool 47 points. 47 POINTS! The Greek Freak's team currently has the best record in the NBA and they showed why on Friday night. This Thunder team was becoming a bit too Icarus-y and had a decent chunk of the fan base dreaming of the two seed in the West until that game. The loss brought those people, including a small part of me, back to earth quickly. Look, OKC is a good team, but they are not going to win the title unless CP3 can somehow elevate his game to unforeseen heights and become a dude throughout the entire playoffs. He's been fantastic this year but there are only a handful of healthy dudes in the league. The list is, in no order, Kawhi, LeBron, and Giannis. Potential dudes for this year's playoffs could be Jayson Tatum, Jimmy Butler, Joel Embiid, Nikola Jokic, Donovan Mitchell, RUSS, Pascal Siakam, and Luka. If your team doesn't have one of those 11 players then you probably are not going to win the title this year. Open for debate though. You know who is trying to win a title? A bunch, but now much less, of Democratic candidates. Mayor Pete Buttigieg and Amy Klobuchar abruptly dropped out of the race the last couple of days and threw their support behind Joe Biden. Interesting timing but it looks like some top Democratic leaders pushed those two out of the race in order to try and consolidate the moderate lane of the Democratic party before Super Tuesday happens. The consolidation went to one person: Joe Biden. This is all in a valiant effort to defeat self-proclaimed Democratic socialist Bernie Sanders. Super Tuesday is tomorrow so buckle up. Since last week, the stock market has imploded thanks to the coronavirus, VP Mike Pence adds an unwanted title to his business card at his work, the South Carolina Democratic Debate came with a firework show, President Trump visits India to chat about "freedom gas," even oil and gas super majors are failing in the market, and all oil and gas companies are pumping the brakes on spending dollar bills in 2020.

March 2, 2020

U.S. stock market implodes quicker than the 2004 Lakers

The might Lakers had quite the dynasty going at the beginning of the 2000's decade. Pairing Kobe with Shaq worked wonders from 2000-2003 as the Lake-show won three straight titles and seemed to barely break a sweat doing so. The U.S. stock market has had a marvelous run the past three years that pretty much equates to winning three straight NBA titles. However, in-team fighting led to the downfall of the Lakers eventually as they lost to perhaps the least talented team to ever make an NBA Finals in the 2004 Detroit Pistons. Don't get me wrong, the '04 Pistons were a really well built team that played well together, but they had zero all-timers on that team. It is really hard to win a title without an all-timer and they did it by taking down a team that had two in their primes. The U.S. stock market is experiencing its own downfall in year four. However, instead of being infected by normal economic stuff, it has been infected by the coronavirus. Investors started to become extremely spooked early last week as the first case of "community spread" coronavirus was reported in Northern California. This is believed to be the first known infection in the U.S. that cannot be directly traced back to that person traveling to any country that is already dealing with the virus nor can it be traced back to coming into contact with anyone who has the virus already. Investors began to sell-off stocks heavily beginning on Monday (24th) and that pace accelerated significantly after it was announced on Wednesday evening (26th) that the first community spread had occurred in America. This news was released to the public shortly after President Trump's press conference on how the U.S. is planning to handle the potential pandemic (more on that in the next blurb). Roughly $18B has left the U.S. stock mutual and exchange-traded funds during the week ending Wednesday (26th), according to Bank of America analysis data from EPFR Global. A company called Alight Solutions had this interesting nugget:

"Trading activity among investors at large employers was about 11 times higher than normal on Thursday, a rare occurrence since 2008."

Then the Wall Street Journal (WSJ), followed that data point up with this:

The frenetic trading has helped push the S&P 500 down more than 10% from its recent highs at unprecedented speed, with the broad index falling from a record into a correction in just six sessions.

U.S. markets are not the only ones feeling the pain. Stoxx Europe was down 3.5%, Japan's Nikkei was down 225 points, South Korea's Kospi was down 3%, and Australia's S&P/ASX 200 was also down more than 3% as of mid-day last Friday (28th) alone. Then of course, the global benchmark for crude oil, Brent, is getting hammered as well as that is viewed as a risky (or riskier than usual) asset to own at the moment as demand forecasts for 2020 have fallen off a cliff. Lastly, Neil Dwane, global strategist at Allianz Global Investors, threw in some behavioral economic theory into the equation that makes a lot of sense:

“I personally can’t see why cheap money will stop this rout because this is the type of uncertainty that isn’t economic. It isn’t about Trump and trade uncertainty. This is about you and I deciding that we are going to change our behaviors for a while.”

Couple of charts that show the bloodbath that is going on right now:

VP Mike Pence is trying to get a promotion, asks for more stuff to do, gets put in charge of handling the coronavirus

Sometimes shooting for the stars doesn't go so well for you and you end up being put in charge of trying to stop what could be a global pandemic from gaining a foothold in America. Mr. Pence was probably hoping to head up a small trade war with Portugal or something but then President Trump announced last Wednesday (26th) that Pence would instead be in charge of the federal response efforts to prevent the coronavirus from infiltrating the U.S. and/or try to stifle the spread of the unknown disease when it does fully arrive stateside. In Trump's press conference, he bragged about how prepared his administration was to handle the virus as he said:

“We’re very, very ready for this, for anything, whether it is going to be a breakout of larger proportions or whether or not we’re at that very low level. Because of all we’ve done, the risk to the American people remains very low.”

Shocking that he said "we" instead of "I" right? He is claiming to be prepared despite proposing to cut key agencies that will be overseeing the virus preparation and response planning in his recently released budget request to Congress. In his proposed budget, Mr. Trump planned on cutting the Center for Disease Control's (CDC) budget by 16% and the Health and Human Services' (HHS) budget by 10%. This is on top of Mr. Trump already having eliminated a key global health position on the National Security Council that was created by former President Obama in response to the Ebola outbreak during his presidency. So, you know, that specific position was created to handle this exact sort of thing. Instead of installing some type of health pro to the position, Mr. Trump decided to hand the responsibility over to Mr. Pence. In all fairness, there is a decent chance that Mr. Pence has watched a couple DIY YouTube videos on how to control pandemics so he should be good to go. Mr. Trump also announced that he will be funding the virus prevention and control efforts with $2.5B of dedicated dolla bills. $1.25B will be new funds and the other $1.25B will be re-purposed funds. However, $40mm of the re-purposed funds is being redirected out of a fund that specifically helps low-income Americans pay their energy bills. No good. The $2.5B is still viewed as underfunded by both sides of the isle. The Democrats, led by Senate Minority Leader Chuck Schumer, proposed an $8.5B plan. House Minority Leader Kevin McCarthy said that he expects the package to be closer to $4B. Either way, both are higher than Mr. Trump's proposal. The exact amount will be set by Congress from the sound of it though. Mr. Trump said during his press conference that he will leave it up to Congress to set the amount and then he will "take it." If all else fails, then maybe the U.S. could offload the Knicks to Canada for $5B and have the funding issue fully resolved.

Last week's Democratic Debate was hotter than Steph Curry when he turns into Chef Curry

And here we were thinking the debate in Nevada could not be outdone after Senator Elizabeth Warren grilled Mayor Mike Bloomberg at a 6,000 degree temp and Mayor Pete Buttigieg kept going after Senator Amy Klobuchar for some reason. Shame on us. The Democratic Debate that took place last week in South Carolina was highly talked about afterwards but not in a good way. If there was a playbook that spelled out how to lose the general election by putting on a poor primary process, then the Democratic Party seems to have read it and are following it to a T. As Axios points out, instead of focusing on things like the coronavirus and how to defeat incumbent Donald Trump and presenting a unified Democratic effort to do so, the candidates spent most of the time shouting loudly at each other, going over their time limits, and talking at the same time with no regard for the moderators who struggled to keep things in check. For example, it took 83 minutes for the moderators to get around to the coronavirus threat even though this has been by far and away the biggest news story of 2020, especially over the last couple of weeks. Mr. Bloomberg's ban on big soda drinks was talked about before the coronavirus. Dan Balz from The Washington Post (WaPo) provided a succinct summary:

The tone of the debate ultimately became a metaphor for the Democratic race itself, as it was marred repeatedly by candidates interrupting one another, talking over each other and constantly ignoring the moderators’ efforts to bring some order to the unruly evening. The event did little to raise the confidence level of the Democratic voters who will be selecting a nominee to go up against President Trump.

Senator Bernie Sanders cleaned house in the Nevada Caucuses so the field finally turned some attention towards him and began the attacks on the Democratic front-runner at the SC debate. Many times though, the field became distracted and went at each other instead of focusing on the front-runner. Ms. Warren decided to mostly attack Mr. Bloomberg again and has largely stayed away from going after Bernie overall. Perhaps there is a VP vacancy in the waiting for Ms. Warren in the event Bernie keeps his momentum and wins the right to represent the Democratic Party in the general election? Mr. Bloomberg stepping onto the debate stage for the last two rounds may have been the best thing that could have happened for Feel the Bern. The field was so focused on obliterating Mr. Bloomberg in the Nevada debate, and they did, that Bernie never really received that much attention. Then he won big in Nevada right after that. Then the field realized they have a front-runner on their hands who honestly, isn't really a Democrat which raises real concern in the Democratic Party on whether or not Bernie has any shot at defeating Trump in the general election. Even with that realization, Bernie escaped the debate relatively unharmed even though he praised parts of former Cuban Dictator Fidel Castro's policies the week of the SC debate. Bernie has a strong and enthusiastic base. That is great and needed in order to win the primary. His policy stances may alienate far too many Democratic voters plus nix any chance of moderate Republicans to vote for the Democratic candidate in the general election, thus paving the way for four more years of Trump. Doesn't this all sound eerily familiar to how the 2016 Republican Primaries went? There was a candidate who really didn't have a lot of Republican ideals that he stood for who ran a campaign that carried with it a ton of enthusiasm from his base. Then centrists candidates never consolidated so their votes were continually split up between each other which opened the door for the outsider candidate to win primary after primary riding the strength of his core base. Then the outsider went on to win the general election and now America has Trump as its President. Temperament wise, Bernie is nothing like Trump. He at least seems to do a decent job of respecting his peers and those against him. The comparison I am trying to make between the two is just that both have strong bases, the centrists candidates that are running against them cannibalize the moderate voters' ballots, and the outsider candidate will have too big of a lead before the centrists candidates finally decide to consolidate. The next week will likely provide America a binary response on whether or not Bernie will be the Democratic Nominee after South Carolina and Super Tuesday voters cast their ballots. If Sanders finishes strongly, then we very well could be looking at Bernie as the nominee by this time next week.

President Trump visits India, brags about Freedom Gas

Ain't nobody want that imprisoned gas. Er'body only wants that Freedom Gas. The Trump Administration has started to set its sights on India as the next opponent / friend in its economic war agenda. Mr. Trump is currently picking trade wars with China and a little bit with the EU so he decided to start working on another one. However, Trump's visit to India last week was met with pomp and fanfare everywhere as Indian Prime Minister Narendra Modi unveiled the red carpet for the U.S. President. This was probably in an attempt to, smartly, stroke Trump's ego and lessen his intensity in trade negotiations. The visit by Trump was centered around discussing a "trade deal" that included improving India's natural gas network, a $3B deal for India to buy military equipment like G.I. Joe action figures, a paintball gun, and an xbox with Call of Duty probably, and nonbinding accords on mental health and drug products. Another key part of the negotiations was centered around trying to persuade India to sign up for more American produced natural gas in the form of liquefied natural gas (LNG). Lately, American companies that are trying to build new LNG export facilities along the Gulf Coast have been experiencing difficulties in signing up foreign buyers of American produced LNG due to the future supply picture looking over-saturated at the moment. Without long-term agreements in place, then U.S. LNG export focused companies will have a difficult time in gaining what is called a Final Investment Decision (FID) from entities that are capable of funding the multi-billion dollar projects (mostly major banks). Without FIDs, then there is zero chance the LNG facility can even begin construction. The majority of the FID approval is dependent on the LNG firms securing long-term supply agreements (10-20+ years) with dependable buyers. However, global buyers of LNG, like India, have been reluctant to sign up for long-term agreements since they have had success in buying spot cargoes whenever they need it. For reference, long-term buyers of LNG cargoes have been losing ~$14-$17mm per cargo versus what they could have bought the cargo on the spot market for. I know, I know, I just ended a sentence with a preposition but let's move on from that. The LNG oversupply can be blamed on the U.S., Qatar, Russia, and Australia as each country has built numerous LNG export facilities over the past few years that has caused the glut to shape up. American LNG export companies have turned to the federal government for help in persuading foreign governments to sign up for long-term deals. Mr. Trump and former Energy Secretary and Dancing with the Stars contestant Rick Perry have visited several countries in Europe and Asia touting "freedom gas' and "molecules of freedom" as the superior gas that will help these countries reduce their reliance on Russian and Middle Eastern gas. Even with the help and interesting branding, there has been little positive movement for the U.S., which is why LNG was brought up in Trump's meeting with Mr. Modi last week. Exxon and Chart Industries Inc. signed an agreement to help improve India's natural gas network during Mr. Trump's visit, but that really has been the only fruitful thing for American natural gas that has came out of that meeting so far. Time will tell how that meeting pays off for both countries. Hopefully it'll be positive all around. Mr. Modi declared that the U.S. and India relationship is 'the most important partnership of the 21st century.”

Even super major energy stocks are getting amnestied

The almighty super majors are starting to realize significant stock price depreciation despite paying hefty dividends still. Exxon has a 37 year streak of increasing its dividend annually. Shell has not cut its dividend since World War II. Despite the cash payouts, investors are still fleeing the most asset and cash rich energy companies in the world. Energy as a whole has been the worst performing sector in the S&P 500 for the last decade. A major asset manager based in the U.K. called Sarasin & Partners LLP sold 20% of its stake in Shell for $2.3B last summer and penned a letter to Shell in the process. In Sarasin's letter, it explained how it was dissatisfied with Shell's plan to increase its fossil fuel output over the next decade. That has been the overall crux of the downturn in sentiment towards energy companies over the last ten years. Major oil and gas companies such as Shell, BP, TOTAL, and Equinor have announced plans to transform their business models into lower carbon output businesses by investing in renewable technology and lowering its carbon footprint from its core business of producing and refining fossil fuel products. However, there is significant skepticism from investors about whether or not oil and gas companies can actually execute on their plans to become lower carbon businesses. Fabiana Fedeli, global head of fundamental equities at Netherlands-based Robeco Institutional Asset Management B.V., stated that "just saying that you’re going to start a transition doesn’t mean you’re going to be successful at it.” The Wall Street Journal had an excellent summary of the predicament that oil and gas companies find themselves in:

With low oil prices pressuring the industry’s economics and many investors saying it is too early to know whether the intended transformations will generate significant returns, there is growing skepticism on Wall Street over the sector’s future.

What is an oil and gas company to do? The transition to a more renewable focused future might not generate enough returns for investors, but a commitment to producing what these companies know how to produce best, oil and gas, has significant social, economic, and political headwinds going against it. Shell has invested $2.3B in "new energies" that includes wind and solar power since 2016. During the same time period though, Shell has invested $35B in its core business of exploring for, and producing, oil and natural gas. Renewable investments have made up ~6.5% of Shell's investments into energy production since 2016. Not bad, but this still has not prevented Shell's stock price from being shelled (eh?? eh???) over the past year as it has lost 25% of its value. Lastly, the name of the game for an oil and gas company used to be to amass as many crude oil reserves as possible in order to increase the value of the company. Not any more though. Last tidbit is from the WSJ:

A study published by the National Bureau of Economic Research found that investors view undeveloped crude reserves as a reason to discount a company because of the risk that climate policies will curb future oil demand and leave some resources permanently underground and worthless.

Lower CAPEXs for everyone!

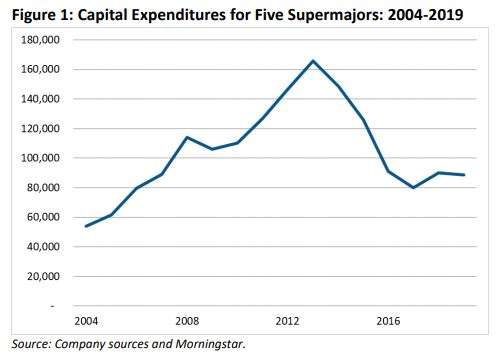

A prudent thing to do in light of lower earning potential is to lower your spending. That is precisely what five super major oil and gas producers - ExxonMobil, Shell, Chevron, Total and BP (aka Fab 5) - ended up doing in 2019. As written about above, oil and gas company valuations have been under extreme pressure from the investment community lately. The returns simply are not there like they used to be from the traditional oil and gas production business model. The Institute for Energy Economics and Financial Analysis (IEEFA) issued a report recently that showcased the Fab 5 invested just "$88.7 billion on capital projects last year, down nearly 50% from the $165.9 billion they spent in 2013." The chart below displays the volatility of CAPEX for the Fab 5 since 2004:

The Fab 5 used to be able to make a consistent 20ish% rate of return on oil and gas investments, but that was back when oil hung out around $100/bbl. Then the crash happened in 2014-15 and oil prices have never really stayed above $60/bbl for very long. Returns on investments have crashed accordingly. The $88.7B spent in 2019 is the lowest number for the Fab 5 since 2007. As Sam Presti, wizard of Thunder hoops, stated once, "scared money don't make none," but apparently oil and gas investments don't make none either. According to the IEEFA:

"The majors have responded to weak stock prices with heavy buyback programs; the five super majors in the report have spent $536 billion on dividends and buybacks, while generating $329 billion in free cash flow. They’ve had to cut capital spending, sell assets and borrow money to make those dividends payments."

Yeesh. Even the super majors can't spin off enough free cash flow from operations at current prices to meet all of their obligations.

Thoughts of the week

Two things I will never understand: 1) why people choose to pay to run in a race; and 2) why people pay to jump out of an airplane that is flying perfectly fine.

I think it would be fun if, say, a person named Jack or Edward or whatever decided to name his second son "Jack XV" or "Edward the XXII" even though the kid would actually just be the second kid in the lineage named Jack or Edward because his older brother is named Brodie or Charles or something. People would automatically think that "Jack XV" must have some awesome lineage behind his name with so many cool stories. Then as the parents you could just make up a new story whenever you feel like it and go with it until it becomes boring and then you can just make up a new one.

Comments